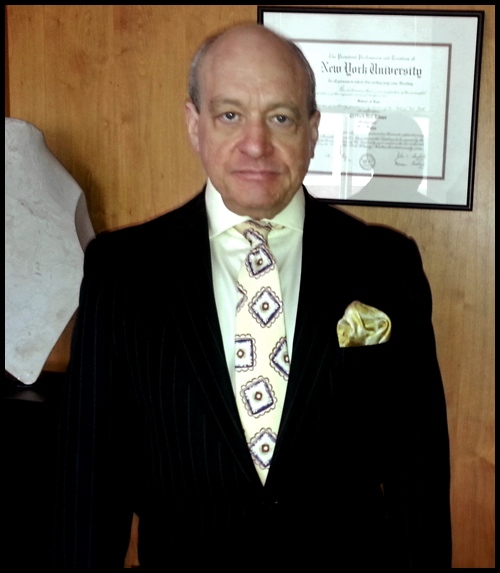

The Offices of Clifford N. Ribner, Tax Attorney, J.D., LL.M. (in Taxation)

Clients throughout Oklahoma – and the Entire USA.

(918) 582-9200

320 So. Boston Tulsa, Oklahoma 74103

Clifford N. Ribner is an experienced barrister with expertise in tax law, a particularly complex specialty that requires a unique skill set to master. His experience reading complicated and endless statutes, as well as putting together various pieces of information to understand how they work together in the real world, allows him to approach other areas of law with a unique perspective and expertise. With over 40 years of experience, Clifford N. Ribner has the knowledge and skills necessary to provide legal guidance and representation to clients facing a wide range of legal disputes.

Federal and State Tax Law Services

As a federal and state tax law expert, Clifford N. Ribner can provide you with a wide range of legal services to help you resolve disputes with federal and state tax authorities in Oklahoma and New York. His expertise includes:

- IRS Appeals — You can appeal any action or position taken by IRS Revenue Agents or Revenue Officers, including if they incorrectly or unfairly claim you owe them money for any reason, or if they impose wage garnishments, liens or levies against you or your assets. If your appeal is timely, you can even prevent such adverse actions by the IRS until after you have had your appeal heard by an Appeals Officer, whose actions you can even appeal in court. Nothing gives you more firepower in prosecuting such an appeal than having a trained, experienced tax litigator representing you.

- Don’t Try To Represent Yourself Against the IRS — When you hire us, we alone deal with the IRS on your behalf in all matters, including any audit or other investigation, any appeal, or any collection action they might take against you. You can then go about your life secure that your position against them will be maximized, and that you will not inadvertently make the kind of damaging statements that cost Martha Stewart so much. This is of particular concern if you have unfiled tax returns.

- Offers in Compromise — Many taxpayers find themselves in a position where they can never pay off the IRS. The penalties and interest the IRS continues to add make it mathematically impossible. The liens they impose prevent borrowing to pay them off. However, there is an IRS program which, if you qualify, allows you to wipe out everything you owe them, including penalties and interest. It eliminates any tax liens, often for a fraction of what you owe them. Needless to say, the IRS does not like granting these; a trained, experienced tax litigator representing you can give you straight advice on whether, or how you might, qualify for this program, and then handle this difficult process to maximize the likelihood of your success.

- Delinquent Returns — Many taxpayers get behind in filing tax returns. This is dangerous and can even pose a risk of criminal prosecution. Most people with unfiled tax returns become afraid of what will happen to them when they get back into the system. Only by using an attorney to represent you, as you file old returns, will your communications with your representative be completely confidential. We will handle all communications for you with the IRS, and you can get straight with them.

- See and Understand the IRS ‘ Own Files on You — You have the right to look at the IRS’s file on you. Requesting such records is best done by an attorney who understands how the IRS works and can read and explain to you the coded documents in your file. No red flags are raised by the attorney requesting such. If you are at odds with the IRS in any way, you should never speak directly with them. Many unpleasant tax cases are generated by seemingly normal conversations with them by taxpayers.

- Innocent Spouses or Injured Spouses — The IRS often attempts improperly to collect taxes from one spouse which, under law, or as a matter of fairness, should be the liability only of that person’s spouse or former spouse. In these cases, the injured, or innocent, spouse maximizes their ability to prevent the IRS from doing so by being represented by an experienced tax litigator.

- Minimizing problems from “Cancellation of Debt” Income — Most people and businesses don’t realize that when they settle their debts with credit card companies, banks or other creditors, the IRS may consider all money saved as additional, taxable income for income tax purposes. The IRS calls this “cancellation of debt” or “discharge of indebtedness” income (“COD”) — and the institutions have to report it to the IRS on forms 1099-C. There are, however, a number of exclusions which, if available to you, can reduce, delay, or even eliminate tax liabilities from COD. An experienced tax lawyer can advise you on the potential availability to you of these exclusions — and how to make sure you don’t lose them.

- Representing Taxpayers In Criminal Tax Investigations and Prosecutions — These are the most dangerous and frightening situations a taxpayer can face. I have been lead counsel in numerous jury trials and appeals, in both civil and criminal cases, and none of the taxpayers I have represented in civil or criminal tax investigations have ever been indicted.

Civil and White-Collar Criminal Litigation, Trials, and Appeals

As an experienced litigator, Clifford N. Ribner can provide comprehensive legal representation in all types of civil and white-collar criminal litigation matters, including:

- Shareholder Disputes — Resolve disputes with other shareholders in your business, including disputes over ownership, management, and compensation.

- Beneficiaries of Estates — Legal representation to beneficiaries of estates who may be experiencing disputes over the distribution of assets or other issues.

- Partnership Disputes — Resolve disputes with partners in your business, including disputes over management, compensation, and ownership.

- Trial Lawyer — Clifford N. Ribner is an experienced trial lawyer who can provide legal representation in all types of civil and criminal trials.

- Securities Fraud — Cases involving securities fraud, including cases involving insider trading, market manipulation, and other types of fraud.

- Insurance Litigation — Clifford N. Ribner can represent you in disputes with insurance companies, including disputes over coverage, claims, and bad faith practices.

- Personal Injury Litigation — Legal representation to clients who have been injured due to the negligence or wrongdoing of others, including cases involving motor vehicle accidents, slip and falls, medical malpractice, and more.

- Construction Litigation — Legal representation in construction disputes, including disputes over construction contracts, construction delays and defects, and more.

- Appellate Litigation — Clifford N. Ribner can provide legal representation in appellate litigation matters, including appeals of trial court decisions and appeals of administrative agency decisions.

Contact Us

If you need legal assistance in any of these areas, please contact us to schedule a consultation with Clifford N. Ribner. He will work with you to understand your unique situation and provide the legal guidance and representation you need to achieve the best possible outcome.

Click to Call Now - (918) 582-9200

Contact Tulsa Tax Attorney Clifford N. Ribner for all Oklahoma Tax and IRS Tax Disputes